What was the Hearth Tax?

The Hearth Tax was introduced in England and Wales by the government of Charles II in 1662 at a time of serious economic need. Although it only lasted 26 years, it had a major impact on our ancestors.

The Act decreed that householders who paid more than 20 shillings a year in rent had to pay two shillings per year for each fire, hearth and stove within the property – an approximate £153 per year in today’s money. A payment of one shilling per hearth was collected twice yearly, at Michaelmas (29 September) and Lady Day (25 March), starting at Michaelmas 1662.

The Hearth Tax was hastily put together and many subsequent amendments were necessary. At first, there was no distinction between owners and householders, so the first amendment stated that only occupiers would be liable. This meant that owners and landlords, many of whom were well able to pay the tax incurred, were not liable for payment, while householders were liable unless exempt.

Householders had to make a written return of the number of hearths in their homes within six days of the notice. It was then up to the Parish Constable, on behalf of government officials, to collect all monies in cash, from which he received two pence in the pound for his trouble. Usually escorted by a sub-constable as protection against abuse and theft, he was often ostracised by the local community, making this the most dreaded duty in his year of office.

From 1663, all Hearth Tax lists included numbers of those exempt, but, by 1665 these lists were to include names, rather than numerical totals, which is important for those seeking poorer ancestors. From 1664, everyone with more than two hearths was liable, even if otherwise exempt.

The unpopular Hearth Tax was repealed by William III and Queen Mary in 1689, only to be replaced in 1696 by the Window Tax.

Who was exempt from the Hearth Tax?

Some people were exempt from paying the Heath Tax:

- Paupers who occupied a house worth less than £1 a year in rental value, and had no other property worth more than £1 a year, and income that was less than £10 a year.

- Charitable institutions with an annual income of less than £100.

- Some business premises, such as hospitals and almshouses were also exempt

- Industrial hearths such as kilns and furnaces were exempt, but baker’s ovens were not. Even though the house may have had no hearth, blacksmiths were still eligible for the tax on fire-stoves at their premises.

The process of applying for exemption from the tax was extremely bureaucratic. Individuals first had to obtain signed exemption certificates from the churchwardens, then countersigned by two magistrates (justices of the peace), presumably after much scrutiny of the circumstances! From 1670, printed exemption forms were introduced and local officials recorded the names of those exempt.

What can Hearth Tax returns tell us?

Hearth Tax returns are undoubtedly the most important sources of population records from the time of the Domesday Book until the census of 1801.

For family historians eager to locate their ancestors in the late 17th century, these records are invaluable. The lists, containing householders’ names, the number of hearths and amount they paid, can help us pinpoint an ancestor’s location and narrow down searches in the parish registers. They also indicate their status and allow us to study the distribution of surnames in an area. Later records also include the names of our poorer ancestors who were exempt from the tax. Uniquely the Hearth Tax records for London also often included occupations, making them even more like a census record.

Where to find Hearth Tax records

Hearth Tax records include both Hearth Tax returns or assessments and the documents left by recording those who were exempt. Many Hearth Tax records can now be found online making them much easier to use and understand as they have often been transcribed by people more used to reading 17th-century handwriting.

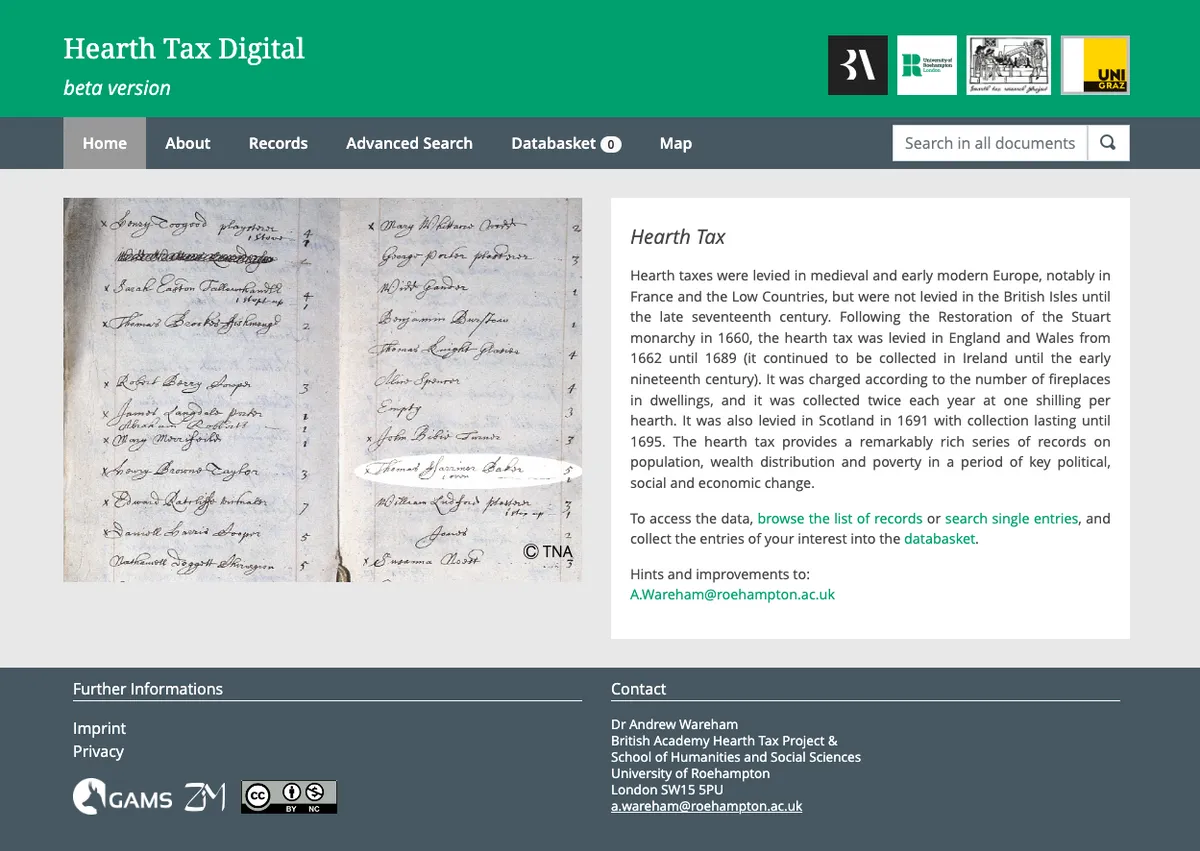

- Hearth Tax Digital - run and maintained by the Austrian Centre for Digital Humanities (University of Graz, Austria) and the Centre for Hearth Tax Research at Roehampton University, this website grew out of the Hearth Tax Online website. It has Hearth Tax transcriptions for Bristol, Cheshire, Coventry, Durham, Essex, Kent, Sussex, Warwickshire, York, parts of Yorkshire and Westmorland. The website also has transcriptions and a searchable database for Hearth Tax records for the City of London and Middlesex, including the Hearth Tax records for Pudding Lane, the source of the Great Fire of London in 1666. The website also has Hearth Tax exemption certificates for Norfolk.

- The National Archives - there are complete lists of Hearth Tax returns from 1662-1666 for England and Wales (E 179) except for parts of Devon, Sussex, and four counties of Wales, and from 1669-1674, making a complete country-wide listing between the two sets. The most complete records for Hearth Tax are those for 25 March 1664. Surviving Hearth Tax exemption forms can also be found in series E 179 for the period 1670-1674.

- ScotlandsPlaces - Scottish Hearth Tax records from 1691-1695 are free to view online

- Irish Hearth Tax - in Ireland, the Hearth Tax covered the years 1663 to 1795 and was recorded on Hearth Money Rolls. Only a few copies have survived for some places (mostly Northern Ireland). Some can be found online for example this hearth tax database for County Tyrone and this one for Antrim and Londonderry.

- Archive.org - Some published transcriptions can be found on the Internet Archive including those for Glamorgan, Staffordshire and many of the collections that are now also available on the Hearth Tax Digital website.

- Hearth Tax exemption certificates - those that have survived can be found in Quarter Sessions records in county archives. These have sometimes been transcribed and published by local record societies and family history societies.